Welcome

Welcome to the home page for Catastrophe, my new book.

A Shooting

Security camera footage shows a man walking alone on a night-dark New York street. Suddenly a second figure appears, hooded and wearing a backpack. As the first man walks on, oblivious, the second produces a handgun, raises it two-handed, and begins firing. At one point the gun appears to jam, at which the hooded attacker cooly rechambers the round and continues pulling the trigger. When his last bullet is spent the hooded figure simply walks away.

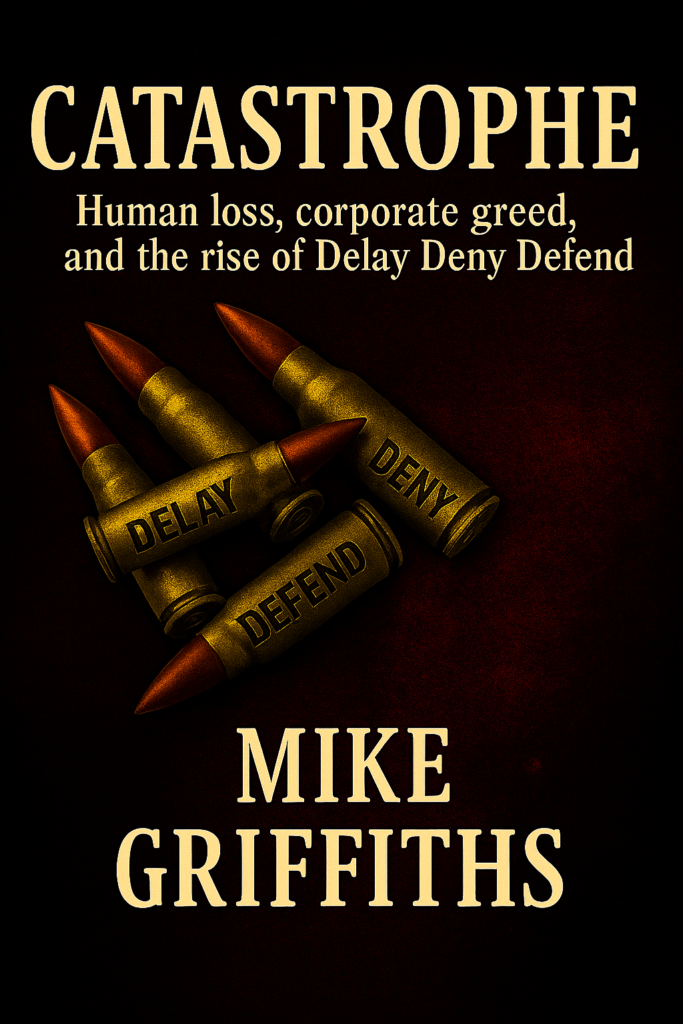

When the police arrive, they discover the words Delay, Deny, and Depose carved into the bullet casings scattered around the dead body.

This sounds like the beginning of a murder-mystery novel, but these events were all too real. The first man in the video, captured on 4 December 2024, was Brian Thompson, CEO of United Healthcare, the largest US health insurer. The second, according to police, was Luigi Mangione, a young, handsome Ivy League graduate with no apparent link to Thompson.

What on earth is going on?

Read On Below…..

Delay Deny Defend

The internal workings of the insurance world are not normally the sort of thing to generate strong emotions, let alone provide the motive for a killing. We buy insurance policies as a boring but important safety net against events we can’t control. Whether it’s a house fire, an auto accident, or a serious illness, we believe can rely on our insurer’s promise to protect us. For the most part, we are correct.

For the most part.

More than anything else, the insurance world fears the unexpected. The viability of any insurance company depends on its ability to predict and manage future losses. When something unforeseen or highly unlikely happens, and the scale of loss is catastrophic, the insurer faces claims it may not be able to pay. When that happens, things can get very ugly indeed.

Catastrophe takes an insider’s look at the insurance world’s response to the largest losses the world has known. It begins with the 1904 Great San Francisco Earthquake and progresses to the asbestos and toxic waste exposure scandals that came to light in the 1980s. The losses generated by some of these events were so great that the insurance industry itself faced oblivion. Even worse would follow, in the form of hurricanes, stock market crashes, terrorism, corporate fraud, and wildfires. (Click on the button below to see the full list). Catastrophe lays bare the workings of the notoriously secretive insurance world, revealing how the industry’s attempts to cope with catastrophic losses have led to today’s insurance affordability crisis and, ultimately, to a shooting in New York City.